Goal

The goal of this project is to create a predicitve model which will identify person of interest or POI from the email data exchanged between employees. We extract various metrics from email data and use it in conjuction with a machine learning model to identify an employee who is potentially performing fraudulent activities.

Data Exploration

The following questions are answered by data exploration:

- Total number of data points : 146

- Total number of poi : 18

- Total number of non-poi : 128

- No of features in original dataset: 21

- No. of NaNs (missing values) in each category

{'bonus': 64,

'deferral_payments': 107,

'deferred_income': 97,

'director_fees': 129,

'email_address': 35,

'exercised_stock_options': 44,

'expenses': 51,

'from_messages': 60,

'from_poi_to_this_person': 60,

'from_this_person_to_poi': 60,

'loan_advances': 142,

'long_term_incentive': 80,

'other': 53,

'poi': 0,

'restricted_stock': 36,

'restricted_stock_deferred': 128,

'salary': 51,

'shared_receipt_with_poi': 60,

'to_messages': 60,

'total_payments': 21,

'total_stock_value': 20}

Since there are very few POIs(18) compared to Non-POIs (128) in the dataset, this is a class imbalance problem.

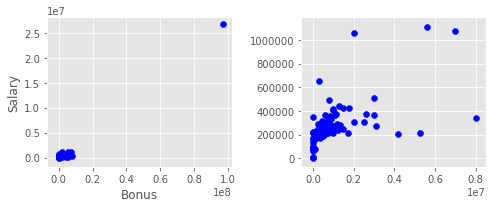

Outlier Investigation

Two outliers are identified for the keys “TOTAL”, “LOCKHART EUGENE E”, and “THE TRAVEL AGENCY IN THE PARK”. These outliers are handled in the original code in preprocessing.

Adding new features to Data

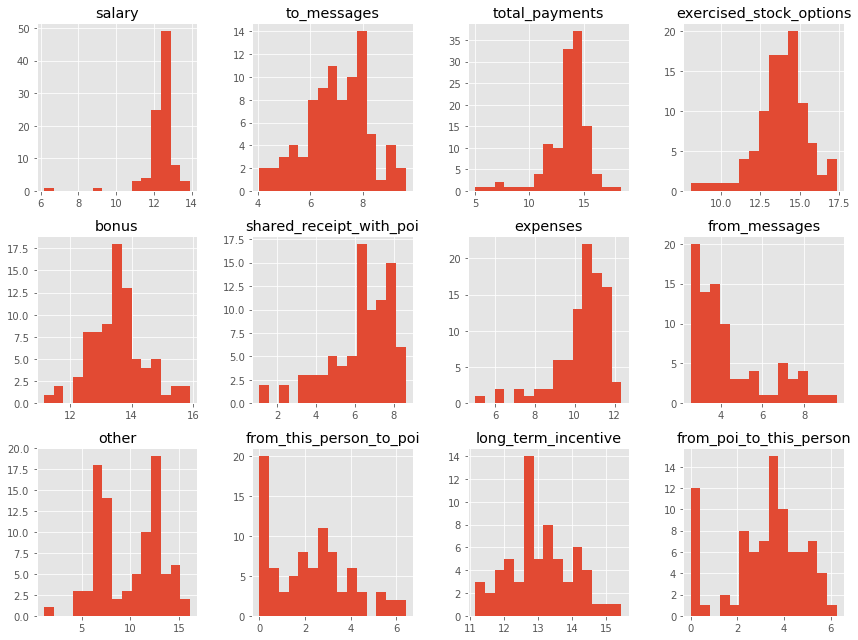

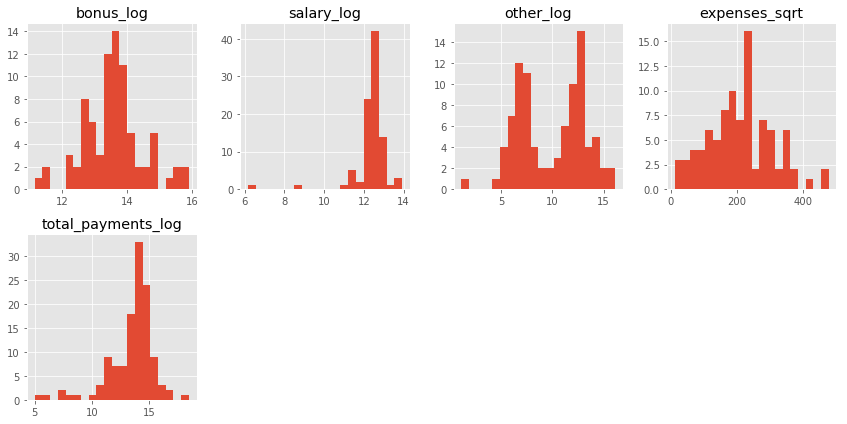

Each column form data is explored through histograms for normality. We identified these parameters to be determinal in identifying “POI” since majority of POIs share non-zero value for this field. A log or sqrt transformed value seems to be more appropriate to get a normally distributed data. Numerical value of 1.0 is added before log transformation to avoid -Inf value while taking log.

-

New features are engineered from the existing ones. We chose the below mentioned features as it gives a more normally distributed data. Feature importances for each features is given below based on the feature selection employed such as

SelecKBest,RFEetc. -

We chose

Expensesfor POIs since it could be higher as the POIs tend to be profligate.- log(1+bonus)

- log(1+salary)

- log(1+other)

- sqrt(expenses)

- log(1+total_payments)

| to_messages | deferral_payments | bonus_log | expenses | poi | deferred_income | email_address | long_term_incentive | salary_log | restricted_stock_deferred | ... | expenses_sqrt | total_stock_value | from_poi_to_this_person | other_log | from_this_person_to_poi | total_payments_log | restricted_stock | salary | total_payments | exercised_stock_options | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ALLEN PHILLIP K | 2902.0 | 2869717.0 | 15.244625 | 13868.0 | 0.0 | -3081055.0 | phillip.allen@enron.com | 304805.0 | 12.215810 | -126027.0 | ... | 117.766719 | 1729541.0 | 47.0 | 5.030438 | 65.0 | 15.316125 | 126027.0 | 201955.0 | 4484442.0 | 1729541.0 |

| BADUM JAMES P | NaN | 178980.0 | NaN | 3486.0 | 0.0 | NaN | NaN | NaN | NaN | NaN | ... | 59.050826 | 257817.0 | NaN | NaN | NaN | 12.114330 | NaN | NaN | 182466.0 | 257817.0 |

| BANNANTINE JAMES M | 566.0 | NaN | NaN | 56301.0 | 0.0 | -5104.0 | james.bannantine@enron.com | NaN | 6.171701 | -560222.0 | ... | 237.280425 | 5243487.0 | 39.0 | 13.669934 | 0.0 | 13.727989 | 1757552.0 | 477.0 | 916197.0 | 4046157.0 |

| BAXTER JOHN C | NaN | 1295738.0 | 13.997833 | 11200.0 | 0.0 | -1386055.0 | NaN | 1586055.0 | 12.495393 | NaN | ... | 105.834777 | 10623258.0 | NaN | 14.793951 | NaN | 15.544391 | 3942714.0 | 267102.0 | 5634343.0 | 6680544.0 |

| BAY FRANKLIN R | NaN | 260455.0 | 12.899222 | 129142.0 | 0.0 | -201641.0 | frank.bay@enron.com | NaN | 12.387031 | -82782.0 | ... | 359.364717 | 63014.0 | NaN | 4.248495 | NaN | 13.626404 | 145796.0 | 239671.0 | 827696.0 | NaN |

5 rows × 26 columns

Histograms of various features

Feature Selection

Feature selection is also called variable selection or attribute selection.

It is the automatic selection of attributes in your data (such as columns in tabular data) that are most relevant to the predictive modeling problem you are working on.

Feature selection methods can be used to identify and remove unneeded, irrelevant and redundant attributes from data that do not contribute to the accuracy of a predictive model or may in fact decrease the accuracy of the model.

We have tried different feature selection techniques and report their scores. The final choice of feature selector depends on algorithm used, since it is the combination which optimize the performance.

What features did you end up using in your POI identifier, and what selection process did you use to pick them?

- Various feature selectors were used in conjuction with the classifier to find the most suited combination.

- The actual number of the features selected is based on the scores computed by

GridsearchCV.

Did you have to do any scaling? Why or why not?

- Yes, feature scaling was used in the logistic regresion model. We did not find any tangible increase in the perfomance using features scaling in Naive Bayes and Decision Tree algorithms.

No. of features after adding 5 new features :25

0 salary

1 bonus

2 to_messages

3 deferral_payments

4 total_payments

5 exercised_stock_options

6 restricted_stock

7 shared_receipt_with_poi

8 restricted_stock_deferred

9 total_stock_value

10 expenses

11 loan_advances

12 from_messages

13 other

14 from_this_person_to_poi

15 director_fees

16 deferred_income

17 long_term_incentive

18 email_address

19 from_poi_to_this_person

20 bonus_log

21 salary_log

22 other_log

23 expenses_sqrt

24 total_payments_log

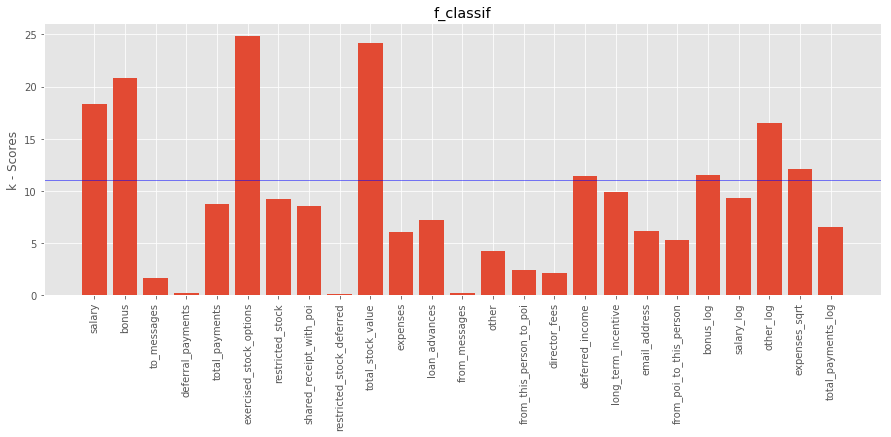

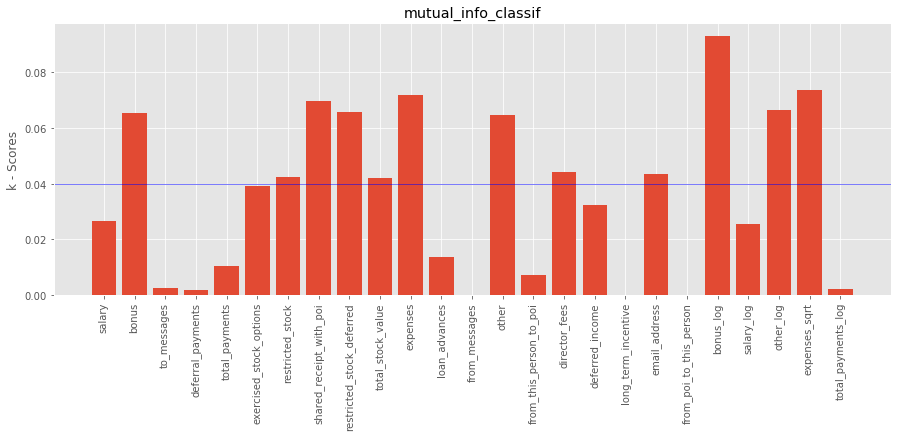

K-Best

Since K-Best is a univariate feature selector, and gives you ranks of top features. We find top 8 (1/3rd of total) features and progressively scan using GridseachCV to find best feature set. The scoring function f_classif and mutual_info_classif is tested to find the k-score.

# Plotting and listing all the features based on k-scores

def get_k_scores(data_dict, features_list, score_func):

"""

Returns a vector with feature scores.

"""

from sklearn.feature_selection import SelectKBest

import numpy as np

# Parsing data_dict and splitting into features and labels

data = featureFormat(data_dict, features_list)

labels, features = targetFeatureSplit(data)

# creating and fitting the selector using the features and labels

k_best = SelectKBest(k='all',score_func = score_func)

k_best.fit(features, labels)

return k_best.scores_

using f_classif

The top features (including new features) using f_classif based on k-scores are:

0. salary

1. bonus

5. exercised_stock_options

9. total_stock_value

16. deferred_income

20. bonus_log

22. other_log

23. expenses_sqrt

using mutual_info_classif

The top features based on k-scores using mutual_info_classif are:

1. bonus

7. shared_receipt_with_poi

9. total_stock_value

10. expenses

13. other

20. bonus_log

22. other_log

23. expenses_sqrt

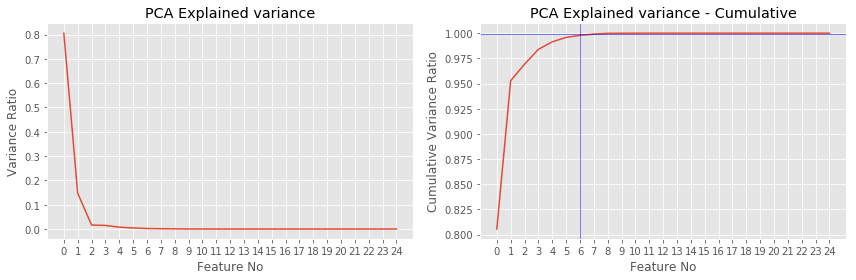

PCA

Unlike univariate feature selector, PCA transform the data into principal components based on eigen values (importance).

- 99.9% of the variance can be explained using the top 6 principal components. Hence n_components = 6 for feature selection. Hence

n_componentshas to be set from 1 to 6 to find the best model without overfitting.

# component selction using pca. Task: To find the minimum number of components to explain variance in features.

from sklearn.decomposition import PCA

pca =PCA()

pca.fit(features,labels)

fig=plt.figure(figsize=(12,4))

plt.subplot(121)

plt.plot(pca.explained_variance_ratio_)

plt.xticks(np.arange(N_FEATURES))

plt.xlabel('Feature No')

plt.ylabel('Variance Ratio')

plt.title('PCA Explained variance')

plt.subplot(122)

plt.plot(np.cumsum(pca.explained_variance_ratio_))

plt.xticks(np.arange(N_FEATURES))

plt.axhline(y=.999,color='b',linewidth=.5)

plt.axvline(x=6,color='b',linewidth=.5)

plt.xlabel('Feature No')

plt.ylabel('Cumulative Variance Ratio')

plt.title('PCA Explained variance - Cumulative')

plt.tight_layout()

plt.show()

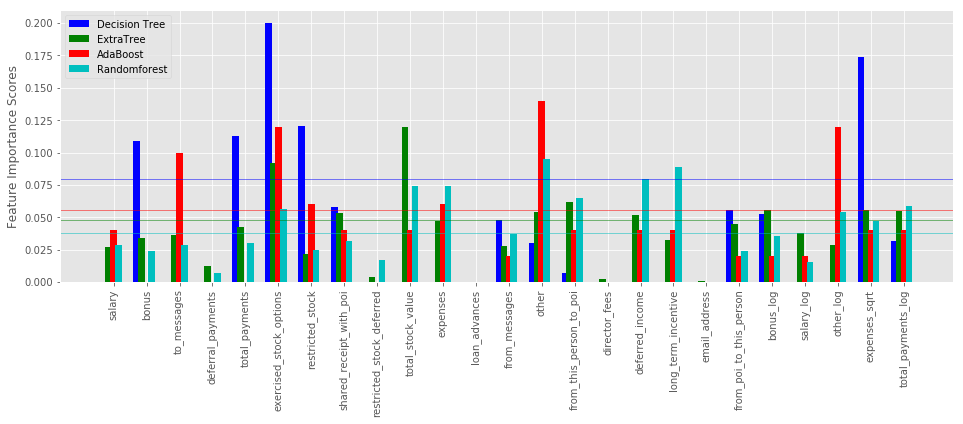

Feature importances from Tree based classifier

Various decision trees like Random Forest and Extra Trees can be used to estimate the importance of features using feature_importances_.

from sklearn.tree import DecisionTreeClassifier

from sklearn.ensemble import ExtraTreesClassifier,AdaBoostClassifier,RandomForestClassifier

classifiers = [("Decision Tree",DecisionTreeClassifier()),\

("ExtraTree",ExtraTreesClassifier()),\

("AdaBoost",AdaBoostClassifier()),\

("Randomforest",RandomForestClassifier())]

COLORS = 'bgrcmyk'

width_bar =0.2

fig=plt.figure(figsize=(16,5))

for i, (name, clf) in enumerate(classifiers):

clf.fit(features,labels)

imp = clf.feature_importances_

plt.bar(np.arange(N_FEATURES)+(0.75*width_bar)*(i),imp, \

width=width_bar,color=COLORS[i], label = name)

plt.axhline(y=0.4*np.amax(imp),color=COLORS[i],linewidth=0.5)

plt.xticks(np.arange(N_FEATURES)+0.3,all_features[1:],rotation="vertical")

plt.legend()

plt.ylabel("Feature Importance Scores")

plt.show()

Recursive Feature Elimination (RFE)

Recursive feature elimination (RFE) provide a small set of features by recursively eliminating features using an external estimator. We found that using around 5 to 6 features give the best scores for various classifiers tested as indicated below.

from sklearn.feature_selection import RFE

from sklearn.tree import DecisionTreeClassifier

from sklearn.ensemble import ExtraTreesClassifier,AdaBoostClassifier,\

RandomForestClassifier,GradientBoostingClassifier

from sklearn.naive_bayes import GaussianNB

from sklearn.linear_model import LogisticRegression

classifiers = [("Logistic",LogisticRegression()),\

("Decision Tree",DecisionTreeClassifier()),\

("ExtraTree",ExtraTreesClassifier()),\

("AdaBoost",AdaBoostClassifier()),\

("Randomforest",RandomForestClassifier()),\

# ("Bagging",BaggingClassifier()),\

("GradientBoosting",GradientBoostingClassifier())]

top_features = {}

for name, estimator in classifiers:

rfe = RFE(estimator, 6, step=1)

rfe.fit(features, labels)

# rfe.ranking_

top_features[name] = [feature for i, feature in enumerate(all_features[1:]) if rfe.support_[i]==True]

print name,":",top_features[name]

Logistic : ['from_poi_to_this_person', 'bonus_log', 'salary_log', 'other_log', 'expenses_sqrt', 'total_payments_log']

Decision Tree : ['total_payments', 'exercised_stock_options', 'restricted_stock', 'shared_receipt_with_poi', 'bonus_log', 'expenses_sqrt']

ExtraTree : ['exercised_stock_options', 'total_stock_value', 'deferred_income', 'bonus_log', 'other_log', 'expenses_sqrt']

AdaBoost : ['exercised_stock_options', 'expenses', 'other', 'from_this_person_to_poi', 'salary_log', 'total_payments_log']

Randomforest : ['restricted_stock', 'shared_receipt_with_poi', 'total_stock_value', 'expenses', 'other', 'other_log']

GradientBoosting : ['exercised_stock_options', 'expenses', 'from_this_person_to_poi', 'deferred_income', 'other_log', 'expenses_sqrt']

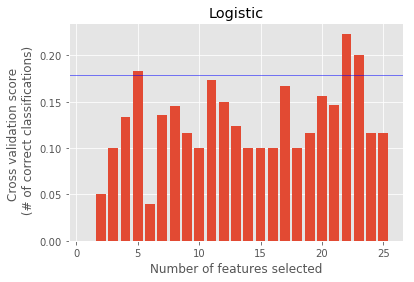

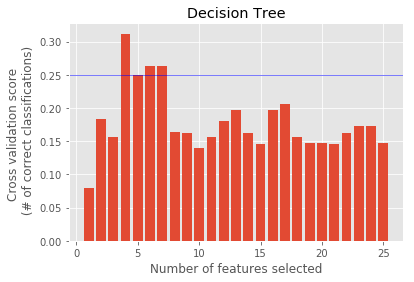

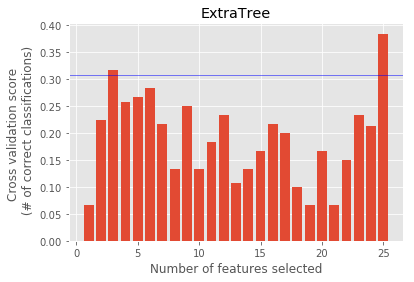

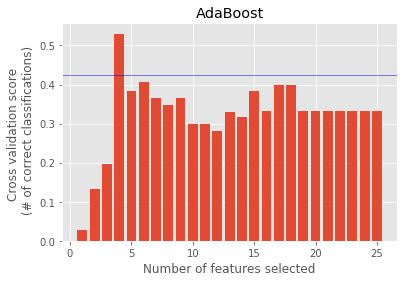

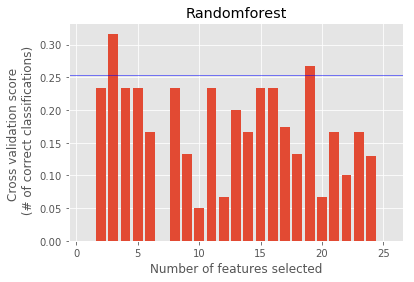

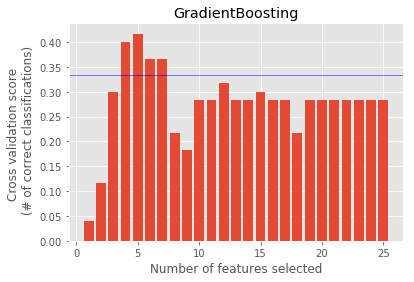

Recursive Feature Elimination with cross-validation (RFECV)

- A crossvalidated

RFEis implemented to find the top features by rank based on the cross-validated scores.X--axis represents the no. of features selected for obtaining the corresponding cross validated score.

import warnings

warnings.filterwarnings('ignore')

from sklearn.feature_selection import RFECV

from sklearn.tree import DecisionTreeClassifier

from sklearn.ensemble import ExtraTreesClassifier,\

AdaBoostClassifier,RandomForestClassifier,\

GradientBoostingClassifier, BaggingClassifier

from sklearn.naive_bayes import GaussianNB

from sklearn.linear_model import LogisticRegression

from sklearn.metrics import fbeta_score, make_scorer

from sklearn.cross_validation import StratifiedKFold

# making a f2 scorer(weighted f1 score for precision and recall). beta =1 \

# recapture f1 score.

# value of beta<1 favour precision more

f2_scorer = make_scorer(fbeta_score, beta=1)

#classifiers used to evaluvate

classifiers = [("Logistic",LogisticRegression()),\

("Decision Tree",DecisionTreeClassifier()),\

("ExtraTree",ExtraTreesClassifier()),\

("AdaBoost",AdaBoostClassifier()),\

("Randomforest",RandomForestClassifier()),\

# ("Bagging",BaggingClassifier()),\

("GradientBoosting",GradientBoostingClassifier())]

top_features = {}

for name, estimator in classifiers:

rfecv = RFECV(estimator, step=1, cv=10,scoring=f2_scorer, verbose=0, n_jobs=-1)

rfecv.fit(features, labels)

print "Feature Ranking\t:",rfecv.ranking_

top_features[name] = [feature for i, feature in enumerate(all_features[1:]) \

if rfecv.support_[i]==True]

print name,":",top_features[name],"\n"

# plot the scores

plt.figure()

plt.bar(range(1, len(rfecv.grid_scores_) + 1), rfecv.grid_scores_)

plt.title(name)

plt.xlabel("Number of features selected")

plt.ylabel("Cross validation score \n (# of correct classifications)")

plt.axhline(y=0.8*np.amax(rfecv.grid_scores_),linewidth=0.5, color='b')

plt.show()

Feature Ranking : [1 1 1 1 1 1 1 1 1 1 1 1 3 1 2 1 1 1 4 1 1 1 1 1 1]

Logistic : ['salary', 'bonus', 'to_messages', 'deferral_payments', 'total_payments', 'exercised_stock_options', 'restricted_stock', 'shared_receipt_with_poi', 'restricted_stock_deferred', 'total_stock_value', 'expenses', 'loan_advances', 'other', 'director_fees', 'deferred_income', 'long_term_incentive', 'from_poi_to_this_person', 'bonus_log', 'salary_log', 'other_log', 'expenses_sqrt', 'total_payments_log']

Feature Ranking : [21 16 18 15 1 1 2 3 22 13 12 20 5 19 4 14 11 10 9 7 1 8 6 1 17]

Decision Tree : ['total_payments', 'exercised_stock_options', 'bonus_log', 'expenses_sqrt']

Feature Ranking : [1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1]

ExtraTree : ['salary', 'bonus', 'to_messages', 'deferral_payments', 'total_payments', 'exercised_stock_options', 'restricted_stock', 'shared_receipt_with_poi', 'restricted_stock_deferred', 'total_stock_value', 'expenses', 'loan_advances', 'from_messages', 'other', 'from_this_person_to_poi', 'director_fees', 'deferred_income', 'long_term_incentive', 'email_address', 'from_poi_to_this_person', 'bonus_log', 'salary_log', 'other_log', 'expenses_sqrt', 'total_payments_log']

Feature Ranking : [15 20 11 19 9 5 1 13 16 10 1 21 14 4 3 17 2 8 18 12 6 1 1 7 22]

AdaBoost : ['restricted_stock', 'expenses', 'salary_log', 'other_log']

Feature Ranking : [19 7 17 15 18 3 11 1 23 1 4 20 13 2 16 22 8 5 21 14 10 12 1 9 6]

Randomforest : ['shared_receipt_with_poi', 'total_stock_value', 'other_log']

Feature Ranking : [17 12 10 18 13 1 6 7 14 5 1 19 9 2 1 20 1 11 21 16 4 15 3 1 8]

GradientBoosting : ['exercised_stock_options', 'expenses', 'from_this_person_to_poi', 'deferred_income', 'expenses_sqrt']

Optimal features and Choice of feature selector

For each classifier a different feature selection procedure was adopted. Each feature selector used in conjuction with classifier is cross-validated with test_classifier. and based on the highest scores, we chose the selector which has to be included in the final model.

Unlike univariate feature selectors such as SlectKBest and RFE, dimensionality reduction techniques like PCA create new combinations of attributes based all features available. In the case of decision tree classifier, the number of features can be controlled by adjusting the parameters.

PCA + Logistic Regression

PCA with n_components = 1 had the best performance when combined with Logistic Regression.

Features Selected :

[‘salary’, ‘bonus’, ‘to_messages’, ‘deferral_payments’, ‘total_payments’, ‘exercised_stock_options’, ‘restricted_stock’, ‘shared_receipt_with_poi’, ‘restricted_stock_deferred’, ‘total_stock_value’, ‘expenses’, ‘loan_advances’, ‘from_messages’, ‘other’, ‘from_this_person_to_poi’, ‘director_fees’, ‘deferred_income’, ‘long_term_incentive’, ‘email_address’, ‘from_poi_to_this_person’, ‘bonus_log’, ‘salary_log’, ‘other_log’, ‘expenses_sqrt’, ‘total_payments_log’]

SelectKBest + Naive Bayes

SelectKBEst with k = 8 had the highest performance for Naive Bayes.

Features Selected :

[‘salary’, ‘bonus’, ‘exercised_stock_options’, ‘total_stock_value’, ‘deferred_income’, ‘bonus_log’, ‘other_log’, ‘expenses_sqrt’]

feature_importances_ + Decision Tree

The feature_importances_ attribute of DecisionTree is used to select features.

##### Features Selected :

[‘exercised_stock_options’, ‘expenses’,’bonus_log’, ‘deferred_income’, ‘total_payments’,’from_this_person_to_poi’, ‘bonus’, ‘restricted_stock’, ‘salary’,’total_stock_value’, ‘email_address’]

Pick and Tune an Algorithm

- What is tuning?

- Tuning a classifier is to adjust the input parameters to obtain the best performance. The performance is often measured using the score of Accuracy, Precision, F1 score etc depending on the data as well as the model.

-

What is the main goal of tuning a classifier?

- The main aim of tuning is to find the optimal value for the model or the highest predictability and generalize well to inseen data. For each classifier we have to find these parameters by adjusting and searching for the values.

-

Is there any possibility for us to over- or under-tune a classifier?

- Yes, often there is a possibility to overtune and under tune a classifier

- Overtuning classifier: Usually happens when too many features are used which will overfit data and fail to generalize to test data.

- Undertuning classifier: Usually happens when there are too little features to train a classifier. This fails to capture the descision boundary properly.

- Yes, often there is a possibility to overtune and under tune a classifier

-

What could go wrong if we tune a classifier aiming prediction scores on top of training data?

- We have to test our model created using training with new test data so as to check whether the model generalize to new unseen data.

Tuning Algorithm

Models are tunned using tuning_[Model Name].py and parameters are printed to a .txt file in the corresponding folder. F1 score is used to evaluate the model since it allows optimizing both Recall and Precision. A ten fold crossvalidation is used in GridsechCV to pick the best tuning parameters, which will split data 10-fold to evaluate the scores for each fold.

Algorithm and corresponding folders

- Logistic Regression - /LR_Results

- Decision Tree - /DT_results

- Naive Bayes - /NB_results

- Adaboost - /ABD_results

Each folder contains .txt file with different parameters tested. the We use the average F1 score as the performance metric and the tunned parameters are used to create the final model for each algorithm as tunned_[Model Name].py.

Logistic Regression (LR)

Logistic Regression is implemented with top 3 performing models reported here. LR_.txt includes all the tested models. LR_6 is selected as the best LR model since it uses only one transformed component of the PCA, and generalize well to test data without overfitting. The model LR_6 can be produced by running tunned_LR.py.

Pipeline used to create the best LR model LR_6

StandardScaler » PCA(n_components=1) » LogisticRegression

All features are selected, and the first component of PCA is used.

ID_ : LR_6 [Selected]

new_features :True

n_features :25

Classifier : Pipeline(steps=[(‘StandardScaler’, StandardScaler(copy=True, with_mean=True, with_std=True)), (‘pca’, PCA(copy=True, iterated_power=’auto’, n_components=1, random_state=None, svd_solver=’auto’, tol=0.0, whiten=False)), (‘classifLR’, LogisticRegression(C=9.9999999999999995e-07, class_weight=None,random_state=None, solver=’liblinear’, tol=1e-06, verbose=0, warm_start=False))])

accuracy :0.766733333333

precision :0.345750154353

recall :0.84

f_1 :0.489867327599

f_2 :0.653238976592

Naive Bayes (NB)

Naive Bayes is implemented with top 2 models passing the required criteria are reported here. NB_.txt includes all the tested models. We take Model-2 in the final Naive Bayes implementaion in tunned_NB.py.

Since Naive Bayes have not many parameters to tune, we control the number of features selected and check the scores.

Pipeline used to create the best NB model Model-2

SelectKBest(k=8) » GaussianNB

8 features selected: [‘salary’, ‘bonus’, ‘exercised_stock_options’, ‘total_stock_value’, ‘deferred_income’, ‘bonus_log’, ‘other_log’, ‘expenses_sqrt’]

Model - 1 [Selected]

new_features :False

n_features :20

Classifier :

Pipeline(steps=[('scaler', MinMaxScaler(copy=True, feature_range=(0, 1))), ('selK', SelectKBest(k=13, score_func=<function f_classif at 0x109f9a9b0>)), ('classifNB', GaussianNB(priors=None))])

accuracy :0.781466666667

precision :0.306948640483

recall :0.508

f_1 :0.382674199623

f_2 :0.449160035367

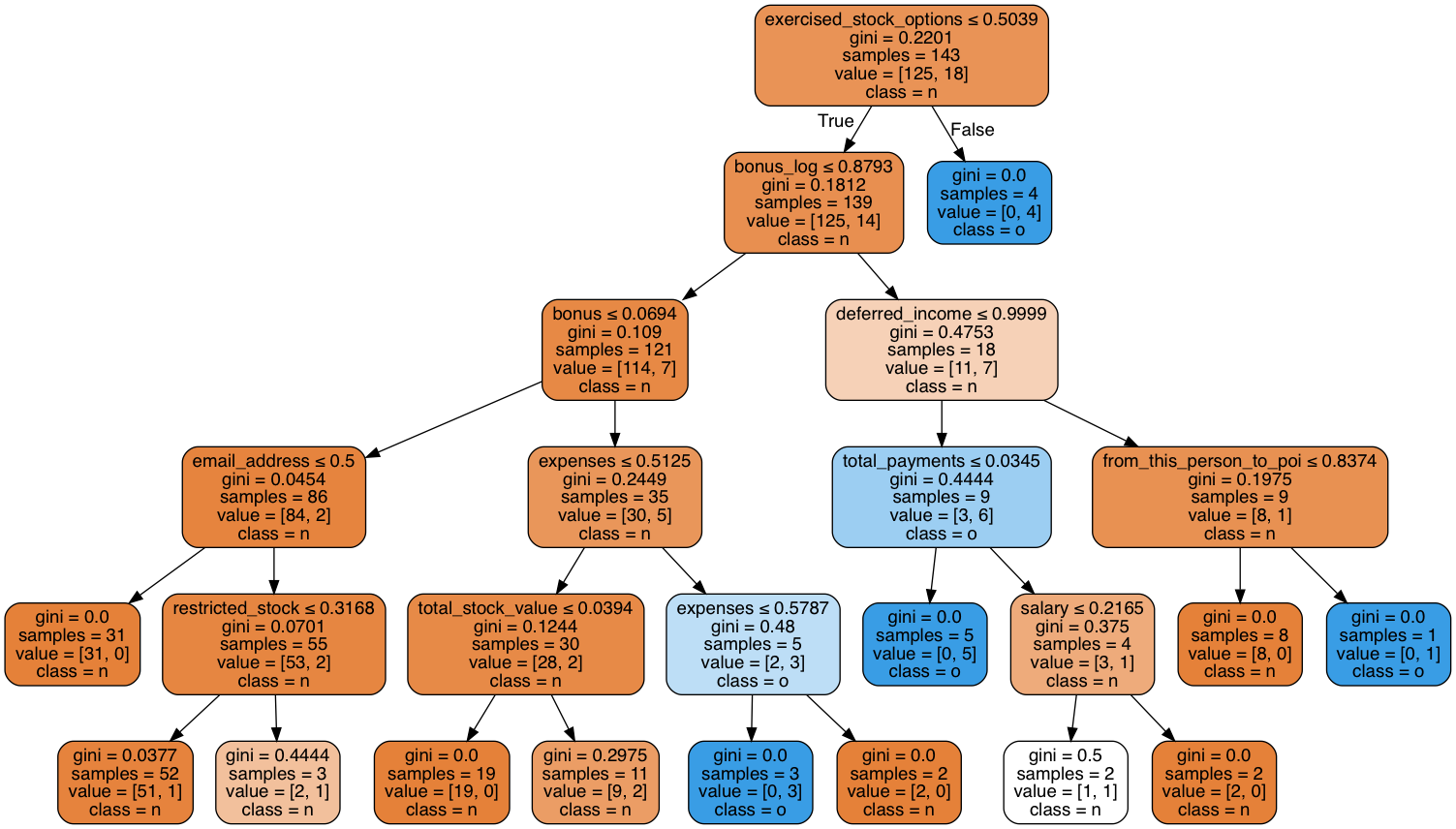

Decision Tree (DT)

Various Decision Tree models are tried and can be found in DT_.txt. The model implemented using DT is shown below.

Pipeline used to create the best DT model Model-2

MinMaxScaler » DecisionTreeClassifier(max_depth=5)

11 features are used as shown in the tree diagram

ID_ : DT_18 [Selected]

params = [{

'classifDT__max_features':["sqrt","log2"],

'classifDT__max_depth':np.arange(3,10)

}]

pipe = Pipeline(steps=[('MinMaxScaler', MinMaxScaler()),

('classifDT', DecisionTreeClassifier(random_state = 42, presort = True))])

DTree = GridSearchCV(estimator=pipe, param_grid=params, scoring='f1', n_jobs = -1, cv=10)

# fitting the classifier after Grid search

DTree.fit(features,labels)

unsorted = zip(features_list[1:],DTree.best_estimator_.named_steps['classifDT'].feature_importances_)

# max_no_features = DTree.best_estimator_.named_steps['classifDT'].n_outputs_

print "Features used",sorted(unsorted, key=lambda x: x[1], reverse=True)[0:11]

dot_data = export_graphviz(DTree.best_estimator_.named_steps['classifDT'], out_file=None,

feature_names=all_features[1:],class_names="non",filled=True,

rounded=True,special_characters=True)

# Printing scores

accuracy, precision, recall, f1, f2 = test_classifier(DTree.best_estimator_, my_dataset, features_list)

print "\n\naccuracy\t:{0}\nprecision\t:{1}\nrecall\t\t:{2}\nf_1\t\t:{3}\nf_2\t\t:{4}\n".\

format(accuracy, precision, recall, f1, f2)

# Visualizing the Decision Tree

graph = pydotplus.graph_from_dot_data(dot_data)

Image(graph.create_png())

Features used [('exercised_stock_options', 0.26311422700723708), ('expenses', 0.202422866059673), ('bonus_log', 0.14368552060296547), ('deferred_income', 0.11622047756050777), ('total_payments', 0.10459842980445701), ('from_this_person_to_poi', 0.074381105638724979), ('bonus', 0.029776132456896025), ('restricted_stock', 0.023416394401911515), ('salary', 0.020919685960891402), ('total_stock_value', 0.019271468279124231), ('email_address', 0.0021936922276114957)]

accuracy :0.853733333333

precision:0.443865740741

recall :0.3835

f_1 :0.411480686695

f_2 :0.394222861842

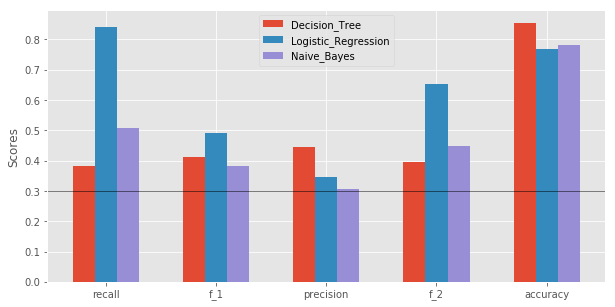

Pick an Algorithm

Pipeline used to create the best models for each algorithm

-

StandardScaler –> PCA(n_components=1) –> LogisticRegression

- SelectKBest(k=8) –> GaussianNB

- MinMaxScaler –> DecisionTreeClassifier(max_depth=5)

We have chosen the best performing model in each algorithm implementation to draw a comparison. All three pass minimum requirements of the project i.e. Precision >0.3 and Recall >0.3. We chose Logistic Regression as the final Algorithm due to its simplicity with highest f1 score.

Selected model

Pipeline used to create the best LogisticRegression [LR_6]

StandardScaler » PCA(n_components=1) » LogisticRegression

All features are selected, and the first component of PCA is used.

Validate and Evaluate

Validation: Model validation is referred to as the process where a trained model is evaluated with a testing data set. The testing data set is a separate portion of the same data set from which the training set is derived. The main purpose of using the testing data set is to test the generalization ability of a trained model. Model validation is carried out after model training. Together with model training, model validation aims to find an optimal model with the best performance based on the scores mentioned below.

Here, validation of the classifier is done through the function test_classifier where data is split into train and test set using StratifiedShuffleSplit. Since we have a class imbalance in our dataset, StratifiedShuffleSplit ensures that the test and train data contains equal proportions of classes. Using the function test_classifier, we perform validation around 1000 fold and aggregate the results to report the performance metric.

The classifier is fitted with training set used to give predictions based on test data. We can define the various perfomance scores based on predicted value and true value as shown in the table below.

| ~ | Predicted Value - 1 | Predicted Value - 0 |

|---|---|---|

| True Value - 1 | TP | FN |

| True Value - 0 | FP | TN |

Precision Score is when the algorithm guesses that somebody is a POI, this measures how certain we are that the person really is a POI.

Recall gives the fraction of POIs identified among all true POIs in the dataset.

Accuracy gives the fraction of POIs and non-POIs identified accurately by model in the total population.

$F_1$ score is the harmonic average of precision and recall.

$F_\beta$ is the weighted harmonic average of precision and recall. $F_\beta$ weighs recall higher than precision where $\beta$ is the weight. Here we use $F_2$, where $\beta =2$

Evaluation

Evaluation of the models for each algorithm is based on the perfomance scores. We found that Logistic_Regression performs well in each scores evaluvated.

Conclusion

We have created a POI identifier based on Logistic Regression as shown above. We have also compared it with other algorithms namely Naive Bayes and Decision Tree. We found that each of these algorithms can be tunned to achieve higher metrics especially if we pick and choose the features with feature selection. In our final phase, we found that Logistic Regression gives the best metric for our data.

References

- http://scikit-learn.org/stable/modules/generated/sklearn.ensemble.RandomForestClassifier.html

- http://scikit-learn.org/stable/modules/generated/sklearn.ensemble.AdaBoostClassifier.html#sklearn.ensemble.AdaBoostClassifier

- http://scikit-learn.org/stable/modules/generated/sklearn.tree.DecisionTreeClassifier.html

- http://scikit-learn.org/stable/auto_examples/plot_digits_pipe.html